Quick Guides

2025 Tax & Planning

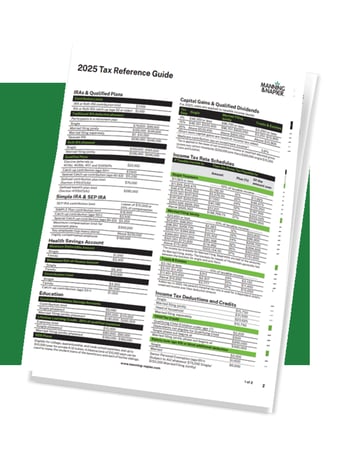

It’s easy to think of taxes in the context of April 15th, but the reality is that tax season never really ends. Use these free reference guides to help you incorporate proactive tax planning into your overall financial plan and ensure you’re maximizing your tax savings year-round.

Download now for all the information you need for taxes—including One Big Beautiful Bill provisions—Social Security, and Medicare.

Better tax management starts here.

Every year the IRS releases new information on tax brackets, retirement savings limits, deductions or credits, and other key tax rules – all of which impact how you manage your wealth.

If it sounds like a lot of information, that’s because it is. Don’t worry though, all of it is covered in these guides.

Everything you need to know for your 2025 taxes

| One Big Beautiful Bill provisions | |

| Personal income tax rates, deadlines, deductions, and credits | |

| Contribution limits | |

| Capital gains rates |

| Estate and gift tax exclusions | |

| Health Savings Account (HSA) benefits and contributions | |

| Taxes for business owners | |

| And more! |

Who we are

Our team has been helping clients reach lifelong goals for 50 years. We provide comprehensive wealth management solutions that fully integrate investments, advisory, and financial planning for people and organizations just like you.

We can help

Financial planning can be overwhelming. We can help. Take the first step by requesting a complimentary consultation with a member of our team. We'll discuss your goals, strategies to reach them, and develop a financial plan that's just right for you.