Schedule your free intro meeting

Did you know that 83% of people that set financial goals feel better about their finances after just one year? It all starts with a conversation.

During this no-obligation session, we'll start by getting to know each other and learning more about your goals, lifestyle, and other important considerations so we can develop a financial plan designed just for you. Schedule yours today and start making progress toward a brighter financial future.

Source: Business Wire

Get Started

Start by providing some basic information, and you'll be matched with an advisor in your area who will follow up to schedule your consultation at a time that's convenient for you.

Do you need an advisor?

You need a financial plan. Yes, you.

Everyone should have a financial plan, but do you need an advisor, too? It might be time to consider working with a financial advisor if you need guidance or advice on your current situation, or you...

| Want ongoing investment advice | |

| Want to save money on your taxes | |

| Need to create an estate plan, or want to explore estate planning tools like trusts | |

| Are interested in learning more about alternative investment options |

| Are starting to plan for or need help navigating retirement including income replacement, RMDs, health care, etc. | |

| Are a business owner looking for customized guidance | |

| Want more support keeping your plan on track |

A good plan can mean the difference between more success than you ever thought possible or coming up short of your goals.

With so much riding on your decisions, you need a partner you can count on to get you to the future you’re dreaming of. Schedule your free meeting with one of our advisors to get started.

Frequently asked questions about the process

Sharing your complete financial picture can be vulnerable, but regardless of how straightforward or complicated your situation may be, knowing what to expect will help you go into your first meeting feeling confident. Here are some frequently asked questions that can help you prepare.

How should I prepare for my first meeting?

Knowing where to start can be the hardest part.

Here’s what you can do to prepare for your consultation:

- Gather statements for any existing accounts or investments like your 401k, investment accounts, mortgage, etc.

- Think about what your goals are – what do you want your retirement to look like? Are you looking to make your investments more tax-efficient? Provide for the next generation?

P.S. If you’re unsure of your goals, that’s okay, too. We can talk through your aspirations together. - Are there life events you’re planning for? E.g., children or grandchildren’s college education(s) or wedding(s), a second home

- Do you have any concerns with your current financial situation?

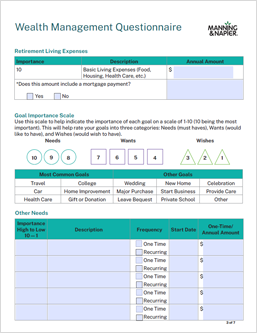

Our wealth management questionnaire is a helpful resource for starting to document your personal and financial information ahead of your first meeting, or just for getting a sense of the type of information we will need.

What can I expect during my first meeting?

The first thing we do is listen.

During our first call, we’ll spend some time getting to know you and your goals. You’ll get to know us too, which is why every consultation is free. Some things we’ll cover:

- What a financial advisor does and how we can help

- Your current financial situation, including current investments

- Your goals

- Answer any questions you have around financial planning and wealth management

What happens after my consultation?

After our call, we’ll get to work creating a customized financial plan just for you, designed to help turn your dreams into reality.

If you decide to partner with us, you’ll have a dedicated service team who will coordinate with you and any other professionals you already work with, like CPAs or attorneys, to set up your account and put your plan in motion.

What type of service can I expect going forward?

To provide you peace of mind, we continuously review your progress.

We'll create action plans and provide recommendations based on any important changes in your life. From regular reviews to stress testing your plan so you understand how your plan will hold up against a range of potential market environments and outcomes, over time and as things change, you can count on us to proactively monitor your progress.

And, since you’ll have a team of professionals dedicated to you and your plan, you’ll always be able to get in touch with someone if you have a question or need extra support.

How much money do I need to work with a financial advisor?

Chances are, no matter how much you have, you could benefit from some level of financial advice. We have clients in every stage of life, and investment options that start with a minimum investment of just $2,000.

What is a fiduciary and is Manning & Napier a fiduciary?

Simply put, a fiduciary is obligated to act in your best interest. When you’re looking for an advisor, it’s recommended to select a fiduciary. After all, would you want to work with someone who wasn’t obligated to act in your best interest?

And yes, Manning & Napier is proud to be a fiduciary. That said, we don’t need a fancy title to know that the right thing to do is whatever is best for our clients. You deserve a partner who is transparent, advocates for you, and is always on your side, and you can count on Manning & Napier for all of that and more.

What is a CFP®?

A CFP® is a CERTIFIED FINANCIAL PLANNER®, and someone who has met rigorous education, training, and ethical standards. Our team is comprised of not only these professionals, but also tax professionals, attorneys, Chartered Financial Analyst® (CFA) Charterholders, Certified Divorce Financial Analyst® practitioners, and other specialized professionals to provide you with the most comprehensive plan possible.

Why work with Manning & Napier?

+ comprehensive planning

We consider your entire financial picture – from taxes, to retirement planning, estate planning, and more, alongside your investments to build you a comprehensive plan.

+ ongoing advice

You’ll get ongoing investment advice, monitoring of your portfolio, and peace of mind knowing you’re on track to meet your goals.

+ personalized support

You’ll enjoy personalized, one‑on‑one service. Your money and your future is personal, and your experience should be too.

+ an established track record

With 50+ years of experience managing money, rest assured we’ve seen it all. Our investment strategies have been time-tested throughout the many market environments we’ve encountered since opening our doors in 1970.

There is no better compliment to Manning & Napier than all of our daughters and their families are using your services.

Our advisor is very attuned to our goals and needs and they work diligently to stay current with our life planning and transition towards retirement. Their team is very responsive and works hard to make life easier for us regardless of the nature of the task. This excellent team service...is why we consider [Manning & Napier] a "10".

Our team is my first choice when we need financial advice, counsel or services. I have referred [Manning & Napier] several times and wouldn't hesitate to do so again. I trust [Manning & Napier] will always be there for me.

[My advisor] has been a phenomenal resource as we've worked together to formulate a plan to achieve my financial goals.

I am very happy to be able to work with [my advisor]. I greatly appreciate the time they take to review my portfolio and explain everything. I also value how they listen to my concerns, questions, or suggestions...and gets back to me quickly.

Resources to help you prepare for your free consultation

CHECKLIST

The Ultimate Financial Planning Checklist

Get a breakdown of key considerations and steps to get started on your financial plan.

CHEAT SHEET

Preparing for Retirement

Designed to help you start to prepare for retirement, this cheat sheet outlines what you need to be thinking about before taking the leap.

QUESTIONNAIRE

Wealth Management Questionnaire

This questionnaire is designed to help you gain an understanding of the type of information needed to build a comprehensive financial plan, and, if you're ready, start compiling that information, all in one place.

Who we are

We strive to be your one-stop shop for financial wellness, which is why we consider all aspects of your financial health, from investments to taxes and more, to build your plan. And with regional service teams throughout the US, we’re prepared to meet you wherever you are – physically and financially.

Follow us

We deliver our big ideas straight to your feed! Follow along for a variety of investment and personal finance insights, plus firm updates and community involvement.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNERTM, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Testimonials are based on unique experiences from current clients and are not representative of all client experiences. Testimonials were solicited from select clients who we believed had positive experiences with Manning & Napier. No cash or non-cash compensation was provided for the testimonials. Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.